Parahyangan Catholic University’s Accounting Study Program won a Competition Grant (Hibah Kompetisi) in the Ministry of Education and Culture’s Kampus Merdeka Competition Program in 2021. With regard to the achievement of this competition grant, Parahyangan Catholic University’s Accounting Study Program organized a series of activities, one of which was the debriefing and mentoring of the Accounting Competition Team by inviting accounting alumni and practitioners to deliver the materials for around 35 students of the Accounting Competition Team selected from the classes of 2018 and 2019.

The students gained a variety of knowledge experiences with current topics relevant to the competition and the future of the competition team in the workplace. On Wednesday, August 4, 2021, an online briefing was held by inviting an alumnus of Accounting Class 2002, namely Mr. Tommy Hartanto, SE. He has 14 years of experience working as an internal auditor and risk consultant in various industrial sectors, especially in the mining and banking sectors. In addition, Mr. Tommy is also a Professional Risk Advisory.

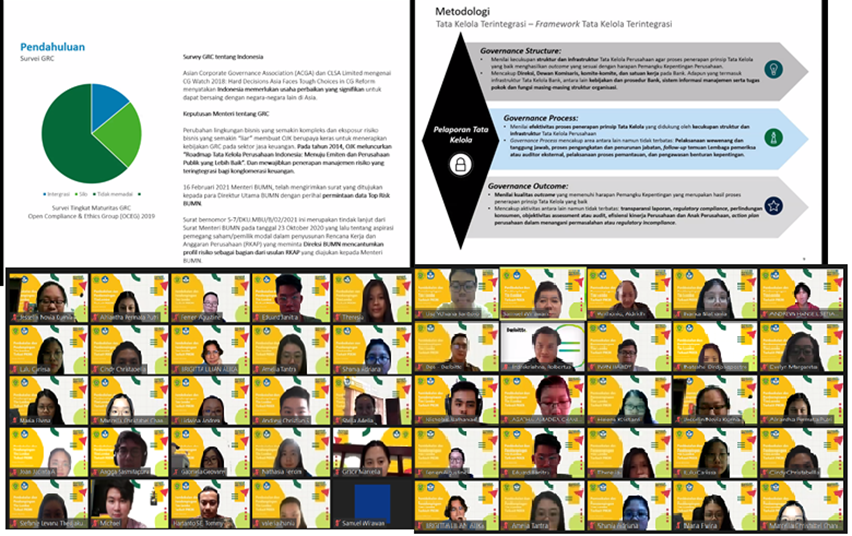

On this occasion, he presented the theme “Strengthening the Implementation of Integrated Governance,” which was very interesting for the accounting competition team of the Faculty of Economics, Parahyangan Catholic University. The session opened with an explanation of GRC (Governance, Risk, and Compliance), where companies face various uncertainties, opportunities, and obstacles in running their business. He also explained that the ideal condition of GRC owned by the organization is to ensure that the objectives of the organization are achieved optimally.

Then there is also an explanation of the integrated governance framework, one of which is Governance Reporting which has three parts, namely Governance Structure, Governance Process, and Governance Outcome. Governance Structure aims to assess the adequacy of the company’s governance structure and infrastructure so that the process of implementing good governance principles produces outcomes that are in accordance with the expectations of the company’s stakeholders. The Governance Process aims to assess the effectiveness of the process of applying the principles of governance, supported by the adequacy of the structure and infrastructure of corporate governance. While the Governance Outcome aims to assess the quality of the outcome that meets the expectations of stakeholders, which is the result of the process of applying the principles of good governance.

Then the session explanation was continued by Mr. Abdiansyah Prahasto regarding internal audit. Deloitte is currently designing an Internal Audit that encourages the transformation of SKAIT with consideration of digitalization, with three value propositions: assure, advise, and anticipate. The value proposition owned by SKAIT can be achieved using digital assets that transform the way internal audit works, capabilities that are more proactive, partnerships that make a big impact, and enablers that allow internal audit to work more optimally. He also explained about the five maturity levels that can determine SKAIT’s current position, consisting of Initial, Repeatable, Defined, Advance and Leading Class by looking at five criteria in the form of Purpose and Remit, Position and Organization, People and Knowledge, Process and Technology, and Performance and Communication.

Furthermore, Mr. Aldrich Anthonio also explained about Risk Management. He explained that the implementation of Risk Management must consider the structure or model of the company, whether it has a Centralized, Decentralized or Mix Model. He also added that risk management is not definite, which refers to regulations, but rather a compromise that is best for the company. There are nine principles divided into three major aspects that are used for an evaluation framework and effective risk management practices: Risk Governance, Risk Infrastructure and Supervision, and Risk Ownership. Risk Governance has four principles: a General Definition of Risk, Risk Management Framework, Roles and Responsibilities, and Roles and Responsibilities of the Board of Directors. Risk Infrastructure and Oversight has three principles: Roles and Responsibilities of Senior Management, Risk Management Infrastructure, and Independent Functions. Finally, Risk Ownership has two principles: Business Unit Responsibilities and Support Functions.

The last session was closed by Mr. Dea, who briefly explained Integrated Compliance. He explained that the compliance function is a series of preventive actions to ensure that bank activities are in accordance with applicable regulations, both externally, such as OJK, and internally, such as company regulations. This Compliance Function must be integrated with the Integrated Compliance Working Unit in all entities. He mentioned that the framework used by the parent company or subsidiaries is expected to be the same in order to be ideally integrated. He also explained about the GCG Self Assessment Model that has been regulated by the BUMN Regulation and the Financial Services Authority (OJK), that each entity must implement good and effective governance and carry out self-assessment of its implementation, and that it is also divided into several industries such as Commercial Banks, Insurance, Financing Companies, and others.

Program Studi Akuntansi Universitas Katolik Parahyangan

Program Studi Akuntansi Universitas Katolik Parahyangan